Winning strategies for my buyers!

When I am working with a buyer I in a competitive market, I start by sharing some of the strategies we can use to get our offer accepted. These are strategies many buyers are using to win in competitive situations. With multiple offers being very common, there are several ways to stay competitive with other offers. Although all of strategies are frequently used in today’s market, be sure to keep in mind that some of these strategies are more risky than others. There are ways to keep some contingencies in place and modify others making the offer more attractive to the seller.

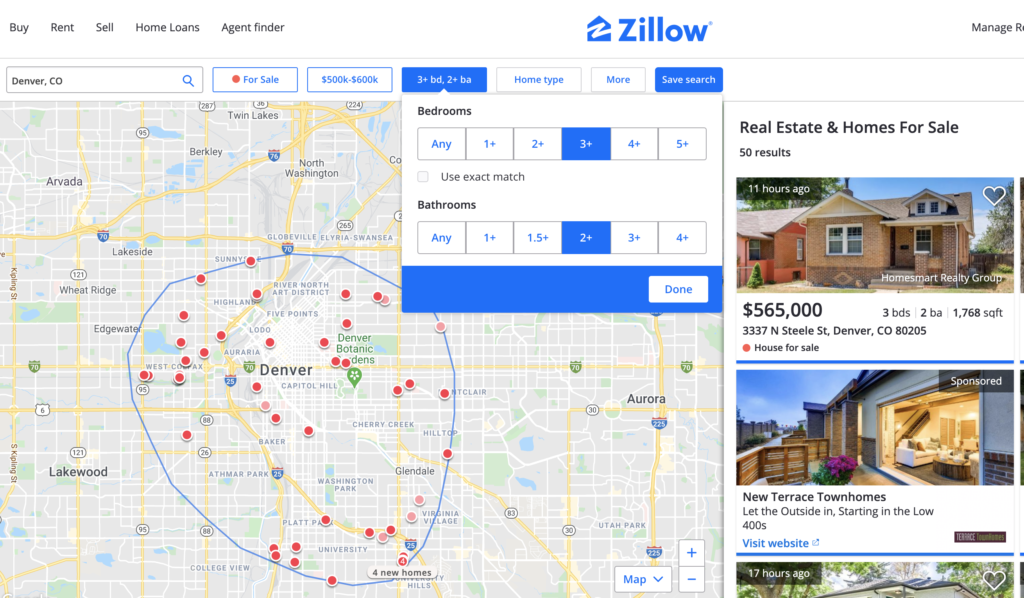

1. PRICE – Of course price is the most important factor. If the home is new to the market, I recommend presenting your highest and best offer ASAP.

2. APPRAISAL GAP – Because many buyers are bidding over the list price or are paying cash, some waive appraisal conditions. If the house does not appraise for the agreed purchase price, the buyer is agreeing to cover the difference at closing because a loan will only cover the appraised value. In an extremely competitive situation we will review comparable homes and I will suggest to you what I believe to be appropriate regarding appraisal.

Example:

List price $400K

Offer: $425K with a $25K appraisal gap.

Appraised Value: $415K

If the appraisal comes back low (below offer value) and the home only appraises for $415K, that would mean you have to bring an additional $10K in cash to gap the difference between the offer and appraised value. You can either choose to bring an additional $10K in cash to closing, or you can also adjust your down payment with your lender to reflect the difference.

It is important to note that the lender will NOT lend on a value higher than the appraised value.

3. TIMELINE – Being cognizant of the seller’s ideal time line is highly important as we go into the offer process. Unoccupied homes typically want a quick close while occupied homes may need more time or even a rent back to find their replacement home. In today’s market, typically we do not charge the seller for a rent back – your first payment will be 30-60 days after closing so this is a good way to sweeten the deal if your move timeline is flexible. The max rent back allowed by lenders is 60 days after closing. Depending on their situation, being able to offer them their ideal circumstances can work wonders to set your offer apart. I will secure these details for you with the listing agent before you make any decisions.

4. INSPECTION – You can offer a limited inspection – example limiting to only major items that cost over $1000 to repair. Some buyers are waiving the inspection objection and taking out the deadlines from the contract. You should always do an inspection no matter what. Limiting inspection or waiving inspection is an effective way to let the seller know you aren’t planning to submit a huge list of cosmetic repairs. Depending on the condition of the home I can make recommendations on how to proceed.

5. ESCALATION CLAUSE – In this case, you present your purchase price and then agree to escalate that price a few thousand above the highest offer (with proof that another higher offer exists). In multiple offer situations, unfortunately this can be a slightly ineffective strategy. Listing agents will typically receive multiple offers with escalation clauses which can make it difficult to know who to go with. Typically sellers go with the highest and best offer vs. putting a lot of weight into the escalation.

6. SIGNING BONUS – This is a newer strategy I have used. We write into our offer that if the seller accepts our offer by a certain time and signs, they will receive a signing bonus.

7. LOVE LETTER – Pull the seller’s heart strings by drafting a letter describing why you love their home. Compliment them on the aspects of the home that they improved. Tell them who you are so they will identify with you personally, instead of regarding your offer as just a number. This is only effective if the owner is personally attached to the home, not for flips or investment properties. Some listing agents won’t allow “love letters” because it can create cases of discrimination. Your letter should NOT include any information regarding —race, color, religion, sex, national origin, handicap and familial status to prevent discrimination based on the protected classes.

8. EARNEST MONEY – You can make some or part of your earnest money non refundable. The net result costs you nothing if you close because all earnest money is credited back to you at closing. When your offer is accepted, earnest money is required within about 48 hours, it is cashed upon receipt and held in a trust account. Making earnest money non refundable shows you are a serious buyer who plans to close, you actually have skin in the game. If you do not add this provision to the contract, your earnest money is refundable if you terminate for any reason within the contract.

9. FINANCING- To make your offer stand out, a solid pre-approval letter will be required along with proof of funds demonstrating you have the down payment in your bank account. Additionally, I will begin working closely with your lender so that he/she knows where we are in the process and is ready to make a personal phone call to the seller’s agent on your behalf. When listing agents review multiple offers, there is a hierarchy of financing options where cash is superior, followed by conventional loans with the highest down payment, FHA loans, VA loans, and then financing programs using down payment assistance programs.

I will also provide a strong cover letter to the listing agent explaining your offer and qualifications. Agents prefer to work with a buyers agent who presents his/herself professionally, is eager to work together as a team, and stays in communication throughout the process. In addition to a cover letter, I will be texting, emailing and calling as appropriate to provide you with accurate and timely information about your offer so you can make educated decisions.

The most exciting phone call I get to make is – “You got the house!”