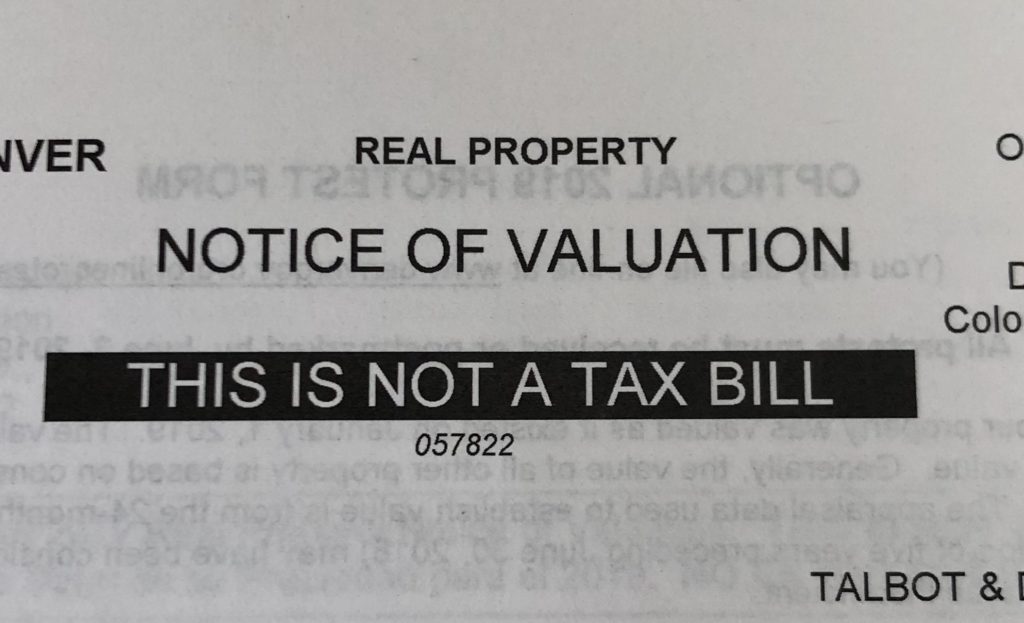

Did you get your “notice of valuation” from the city of Denver? The city is working hard to accurately value your property so they can fairly tax households throughout the county and raise money for public services and projects. Denver recently launched a program called the Denver Tax Receipt where you can actually see exactly where your tax dollars go, I highly recommend checking it out!

Your valuation should be close to you Zestimate or actual market value of your property. If you are the worst house on the block, your property value probably came in higher than the actual market value. If the valuation is not accurate, you have the ability to protest it with the city by June 3rd. Please email me if you need help protesting this value (kassidy@LivingRoomDenver.com).

Did you know Colorado is ranked 5th nationally for most affordable property tax valuations? Our taxes here are actually very low. The median household in Colorado is paying about $1500 in taxes per year in property taxes. The highest state property taxes are in New Jersey where residents pay $7840/year. California has a bad reputation for high taxes, but residents are paying about $3414/year. The red state of Texas actually has very high property taxes, ranked 45 of 50 making it one of the most expensive state property taxes. We looked at tax rates at a state level, but remember that your actual taxes will be determined by the combination of state, county, and city taxes.

Once I understood where your taxes go by using the Denver Tax Receipt, I felt very proud to be contributing to fund the important services that make our great city run. I’m also grateful to live in a state that has affordable taxes when compared to other places. It’s a whole new perceptive once you start looking at the big picture!