Part III: Move Like a Pro – Sell or Buy First?

The real estate market -and life- are unpredictable in 2025. We recommend to plan your move around your life: work, school, vacations, and holidays. It is important to consider that Denver’s market is very seasonal. Like the shape of a mountain, prices typically go up January to July and down from July to December so your timing can make a big difference if you are coordinating two sales. The biggest challenge for move-up buyers? Deciding whether to list or buy first. Each option has pros and cons, and the right choice depends on your financial flexibility, timeline, and comfort level with risk.

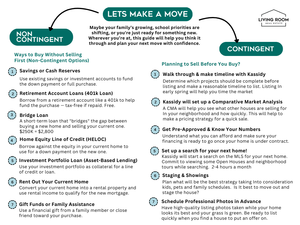

✅ Sell First – For Financial Clarity

- Know exactly what you can afford before buying

- Avoid carrying two mortgages at once

- Avoid expenses of a bridge loans or penalties for using your 401K early

- Can use a rent-back agreement to give you time to move

Selling first helps you avoid costly bridge loans, avoid staging expenses, and gives you a clear budget before buying. Before listing your house to sell, identify neighborhoods that match your lifestyle, budget, and home preferences. That way, once your home is under contract, you’re ready to act fast on a new property because you won’t have much time. Negotiating a rent-back agreement can give you breathing room between closings. This approach requires you to keep your home showing-ready while still living there—no small feat with kids or pets—so start packing early. You may feel pressure to choose what’s available rather than your “dream home” due to timing and available inventory, so it’s smart to browse early but wait to make offers until your current home is under contract. Forty days on market is average right now, so plan accordingly. It is challenging to find a seller willing to accept a contingent offer before your current home is actively listed or under contract. Once your home is under contract, you’ll typically have two weeks to a month to secure your next home. We can arrange for back to back closings and try to get you a rent back from the buyer for 1-60 days so you can pack and move into your new home.

✅ Buy First – For Convenience and Flexibility

- Ideal if you’re looking for something very specific and don’t want to compromise

- Move out before listing—easier for showings and home updates

- More time to search for your ideal home, no pressure of being homeless after selling

- Best for buyers with strong cash reserves or financing options (HELOC, bridge loan, etc.)

If flexibility and convenience matter most, buying first might be the better route—especially if you’re eyeing a very specific home type. We recommend securing a HELOC well in advance to access your equity, or budget extra to utilize a bridge loan if you don’t have the down payment available to pull from savings or a 401(k). You will need to qualify for both your existing mortgage plus your new mortgage and use a product that allows recasting so when you deposit the proceeds from your home sale later you get the financial benefit. Buying first lets you move out, make updates to your old home more easily, and avoid the hassle of showings while living there. However, you’ll need to budget for 3–6 months of carrying both mortgages and additional staging and maintenance expenses for an empty home. Since the final sale price of your current home will remain uncertain, this path is best suited for those with solid financial reserves.

🏡 Finding Your Next Home:

The move-up process is rarely just a financial decision—it’s typically about getting more space, better schools, or a new chapter for your family. Begin with clarity about what you need most, and you’ll be better positioned to find the right home and community.

Read the Full Blog Series:

Part I: Planning Your Future Move-Up