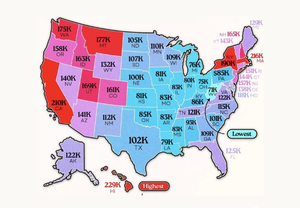

You may have seen this viral map showing the income “needed” to buy a 3-bedroom home in each state. According to it, the recommended income to buy a home in Colorado is $161K. At first glance, it can feel discouraging — especially for first-time buyers or anyone earning under that threshold.

But here’s the truth: you don’t need to earn six figures to buy a home in Denver. In fact, we help people do it all the time with incomes well below what this map suggests.

💡 Why This Map Doesn’t Tell the Whole Story

This map shows averages — not the actual path that many buyers take. It doesn’t account for:

-

First-time buyer programs

-

Local market shifts

-

Creative financing options

-

Negotiation wins like seller concessions or rate buydowns

If you’re feeling priced out, don’t walk away — let’s talk through your options instead.

✅ Real Strategies That Work

Here’s how real buyers in today’s market are making it happen:

1. Low Down Payment Options

Many first-time homebuyers can qualify for loans that require as little as 3% down. That’s a far cry from the traditional 20% many assume is necessary.

2. Down Payment Assistance

Colorado offers several down payment assistance programs that can cover a portion of your upfront costs — sometimes even most of it, depending on your income and the program you qualify for.

3. Buyer-Friendly Market Conditions

With more homes on the market and longer days on market than a few years ago, sellers are more open to offering concessions — like covering closing costs or helping with interest rate buydowns.

4. Local Lenders Who Think Creatively

The lender you choose matters. We work closely with local experts who specialize in helping buyers with moderate incomes secure solid loans.

🏡 Don’t Let Fear or Headlines Hold You Back

Buying a home is still one of the most powerful ways to build long-term wealth. If homeownership is one of your goals — now or in the next year — let’s put a plan in place.

There’s no pressure. Just real talk, real numbers, and a clear path forward.

Let’s connect and explore your options — because dreaming big starts with taking the first step.