Nine months into the Covid-19 pandemic, we have collected some data and feel ready to talk about how this pandemic has impacted the Denver real estate market. Since staying home has become a new way of life, it is logical that the demand for housing has hit an all-time high.

Covid Deals

At the onset of the pandemic, there was a slight opportunity to find a good deal for three months. Those who were willing to purchase amid uncertainty were rewarded (see price decreases below in light blue April, May, and June).

On April 11th the Colorado Real Estate Division banned in-person home showings until May 1st. Offers were being made without seeing properties, inspectors went in and emailed reports and closing happened in parking lots.

Demand for Homes

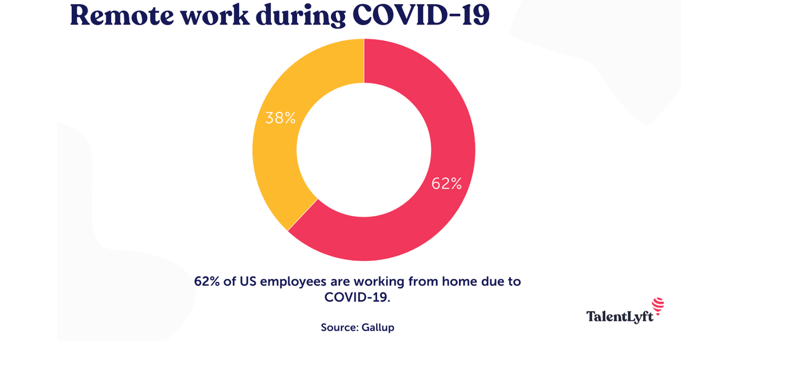

Why would anyone buy under such conditions? Well, at this point everyone needed an extra 1000 sf. Not only were they working from home but they also had kids homeschooling, needed a place for their new Peloton bike, and no escape (aka vacation) insight. Only around 7% of U.S. employees regularly worked from home before the COVID-19. 62% of US employees are working from home now.

Remote Workers with Expendable Income

The demand for extra space has become a priority for many at the same time people actually experienced increased savings. In addition to receiving stimulus money, many saw their monthly bills decrease. Savings were achieved in many categories including commuting, travel, restaurant/bars, entertainment, fitness, personal services, etc. We actually saw personal saving rates increase in April 2020.

Boom in Refinancing

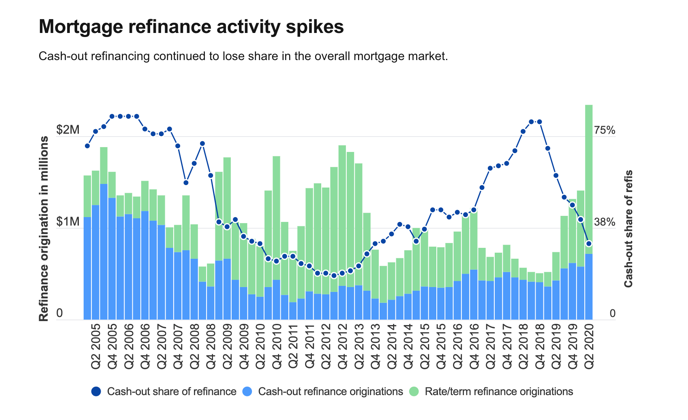

At the same time, most homeowners were able to refinance at a lower interest rate and decrease their monthly housing costs. With interest rates hovering at historic lows of around 3 percent for a 30-year fixed-rate loan, refinance mortgages originated in the second quarter of 2020 represented an estimated $513 billion in total dollar volume. That number was up 130 percent from a year ago, to the highest point in almost 17 years.

We expect total mortgage originations to reach $1.1 trillion in Q3 2020 and $3.6 trillion for the full year 2020. For Q3 2020, refinance originations to be $670 billion.

Lowest Interest Rates

in History

CPR says that 9 in 10 people in Colorado were employed in July 2020. Those people were working from home, had a boost in savings, and were looking to take advantage of low-interest rates. Lower interest rates counterbalance a higher list price and make their monthly payment manageable. I looked back at Mortgage Rates and home values from Zillow and did some quick monthly payment calculations assuming 20% down.

Oct 2016 / 3.42% / $377K = $1636/m

Oct 2017 / 3.85% / $409K = $1850/m

Oct 2018 / 4.9% / $446K = $2226/m

Oct 2019 / 3.65% / $449K = $1975/m

Oct 2020 / 2.88% / $469K = $1900/m

With the lower rates, home prices started to increase again in July. As prices started to soar buyers were unphased. The list price is irrelevant to buyers because they are focused on the cost of their monthly payment.

Competition Pushed

Up Prices

Demand has been strong and inventory has lagged behind. Active inventory between September 2019 to September 2020 is down 42.91% according to DMAR. The low inventory resulted in bidding wars. There aren’t widely available stats so we counted up the number of offers we received on each listing and the number of offers each buyer wrote to get their offer accepted based on Living Room’s transactions. As a whole, it took 2.5 offers per sale within our brokerage since Covid started. It was our experience that single-family homes were more competitive and required closer to 3.5 offers per sale while condo and townhomes were closer to 1.4 offers.

Double the Work

Naturally, it follows that real estate agents were busier than ever during Covid. We are writing 2.5 offers per client and that doesn’t take into effect the number of showings required. In addition, lenders were extremely busy with refinances in addition to new purchases. Lastly, the title companies doubled their workload – instead of one closing with the buyers and sellers, they had to do two separate closings – one for the buyers and one for the sellers. It was double the work all around and we did it in masks.

Low Inventory and

Off-Market Deals

In the graph below you can see the dotted blue line where we expected inventory to be this year before Covid changed the scenario. The solid blue shows our actual inventory. It is shocking to see more homes pending and closed than active inventory.

How is that possible? Answer – many homes sold without ever being listed on the market. The sales were recorded by brokers after the fact. Within our brokerage it happened – friends selling homes to friends, renters buying from their landlord, or buyers placing offers on off-market properties.

Prices Going Up

The high demand for homes in Denver and low inventory is pushing prices up. Since last year, prices in Denver are up 6.4% according to Zillow and predicted to keep going up. Costs are also increasing for building – lumber is a major factor but throughout the supply chain prices are increasing across the board.

People on the Move

During Covid

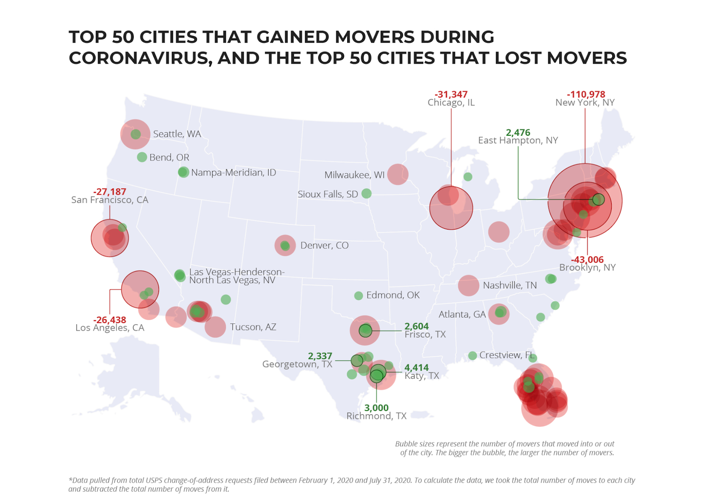

Covid created major change and the change resulted in many moves. According to the Postal Service’s Change of Address requests, over 15.9 million people have moved during the coronavirus. The national trend was a move from cities to the suburbs or smaller towns. Many Denver residents looking for more space left the city. At the same time, Denver has witnessed an influx of new residents from bigger cities. Working remotely has given people the ability to live anywhere and people want to live in Denver. Our city is more open than other cities and we’ve been lucky to not be the center of a major

It’s important to note that the net losses experienced by big cities eclipsed the net gains experienced by the smaller cities. Residents relocating from big cities spread out to smaller areas across the country. A Denver Post opinion piecesaid, “A new wave of urban migrants may be crashing into the suburban and rural West. You could even call them COVID migrants.” People living in Denver are moving to more affordable “Zoom towns” in rural areas. The rural real estate market nationwide has taken off much faster than in urban areas.

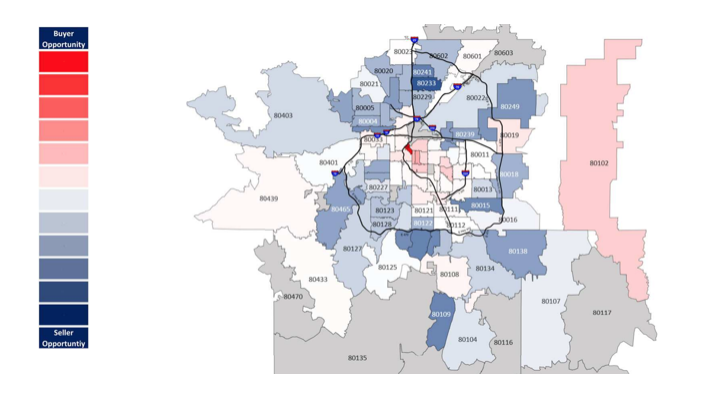

You can see in the graph above that Highlands Ranch, Broomfield, Thornton, Parker, and Evergreen are very in-demand areas while the city center is actually a buyer’s market. People need and want more space. Walkability and the length of commutes is less relevant.

What now?

Typically this time of year is when demand starts to decrease. However, the showings stats below demonstrate that showings have consistently increased month over month since the big dip in April 2020. Masks and other precautions are being taken, but buyers are on a mission to get into a home. The election and holiday will slow down buyers, but we expect a robust 2021.

Conclusion

It was hard to predict how the pandemic would affect the real estate market in Denver early on. Now that some time has passed, we see that stay-at-home orders, low-interest rates, and movement has created a huge boost in demand and therefore prices. Sellers are experiencing the tangible benefits of these price increases when they go to sell, while buyers are battling it out in multiple offer situations. Those lucky enough to win in a bidding war are saved by low-interest rates that make their monthly payment manageable. If Denver can weather the recession of the 2020 pandemic, I’m optimistic about the years to come.

Leave a Reply