Winning Strategies in a strong Seller’s market.

Winning strategies for my buyers!

When I am working with a buyer I in a competitive market, I start by sharing some of the strategies we can use to get our offer accepted. These are strategies many buyers are using to win in competitive situations. With multiple offers being very common, there are several ways to stay competitive with other offers. Although all of strategies are frequently used in today’s market, be sure to keep in mind that some of these strategies are more risky than others. There are ways to keep some contingencies in place and modify others making the offer more attractive to the seller.

1. PRICE – Of course price is the most important factor. If the home is new to the market, I recommend presenting your highest and best offer ASAP.

2. APPRAISAL GAP – Because many buyers are bidding over the list price or are paying cash, some waive appraisal conditions. If the house does not appraise for the agreed purchase price, the buyer is agreeing to cover the difference at closing because a loan will only cover the appraised value. In an extremely competitive situation we will review comparable homes and I will suggest to you what I believe to be appropriate regarding appraisal.

Example:

List price $400K

Offer: $425K with a $25K appraisal gap.

Appraised Value: $415K

If the appraisal comes back low (below offer value) and the home only appraises for $415K, that would mean you have to bring an additional $10K in cash to gap the difference between the offer and appraised value. You can either choose to bring an additional $10K in cash to closing, or you can also adjust your down payment with your lender to reflect the difference.

It is important to note that the lender will NOT lend on a value higher than the appraised value.

3. TIMELINE – Being cognizant of the seller’s ideal time line is highly important as we go into the offer process. Unoccupied homes typically want a quick close while occupied homes may need more time or even a rent back to find their replacement home. In today’s market, typically we do not charge the seller for a rent back – your first payment will be 30-60 days after closing so this is a good way to sweeten the deal if your move timeline is flexible. The max rent back allowed by lenders is 60 days after closing. Depending on their situation, being able to offer them their ideal circumstances can work wonders to set your offer apart. I will secure these details for you with the listing agent before you make any decisions.

4. INSPECTION – You can offer a limited inspection – example limiting to only major items that cost over $1000 to repair. Some buyers are waiving the inspection objection and taking out the deadlines from the contract. You should always do an inspection no matter what. Limiting inspection or waiving inspection is an effective way to let the seller know you aren’t planning to submit a huge list of cosmetic repairs. Depending on the condition of the home I can make recommendations on how to proceed.

5. ESCALATION CLAUSE – In this case, you present your purchase price and then agree to escalate that price a few thousand above the highest offer (with proof that another higher offer exists). In multiple offer situations, unfortunately this can be a slightly ineffective strategy. Listing agents will typically receive multiple offers with escalation clauses which can make it difficult to know who to go with. Typically sellers go with the highest and best offer vs. putting a lot of weight into the escalation.

6. SIGNING BONUS – This is a newer strategy I have used. We write into our offer that if the seller accepts our offer by a certain time and signs, they will receive a signing bonus.

7. LOVE LETTER – Pull the seller’s heart strings by drafting a letter describing why you love their home. Compliment them on the aspects of the home that they improved. Tell them who you are so they will identify with you personally, instead of regarding your offer as just a number. This is only effective if the owner is personally attached to the home, not for flips or investment properties. Some listing agents won’t allow “love letters” because it can create cases of discrimination. Your letter should NOT include any information regarding —race, color, religion, sex, national origin, handicap and familial status to prevent discrimination based on the protected classes.

8. EARNEST MONEY – You can make some or part of your earnest money non refundable. The net result costs you nothing if you close because all earnest money is credited back to you at closing. When your offer is accepted, earnest money is required within about 48 hours, it is cashed upon receipt and held in a trust account. Making earnest money non refundable shows you are a serious buyer who plans to close, you actually have skin in the game. If you do not add this provision to the contract, your earnest money is refundable if you terminate for any reason within the contract.

9. FINANCING- To make your offer stand out, a solid pre-approval letter will be required along with proof of funds demonstrating you have the down payment in your bank account. Additionally, I will begin working closely with your lender so that he/she knows where we are in the process and is ready to make a personal phone call to the seller’s agent on your behalf. When listing agents review multiple offers, there is a hierarchy of financing options where cash is superior, followed by conventional loans with the highest down payment, FHA loans, VA loans, and then financing programs using down payment assistance programs.

I will also provide a strong cover letter to the listing agent explaining your offer and qualifications. Agents prefer to work with a buyers agent who presents his/herself professionally, is eager to work together as a team, and stays in communication throughout the process. In addition to a cover letter, I will be texting, emailing and calling as appropriate to provide you with accurate and timely information about your offer so you can make educated decisions.

The most exciting phone call I get to make is – “You got the house!”

39th Avenue Greenway to open in 2020

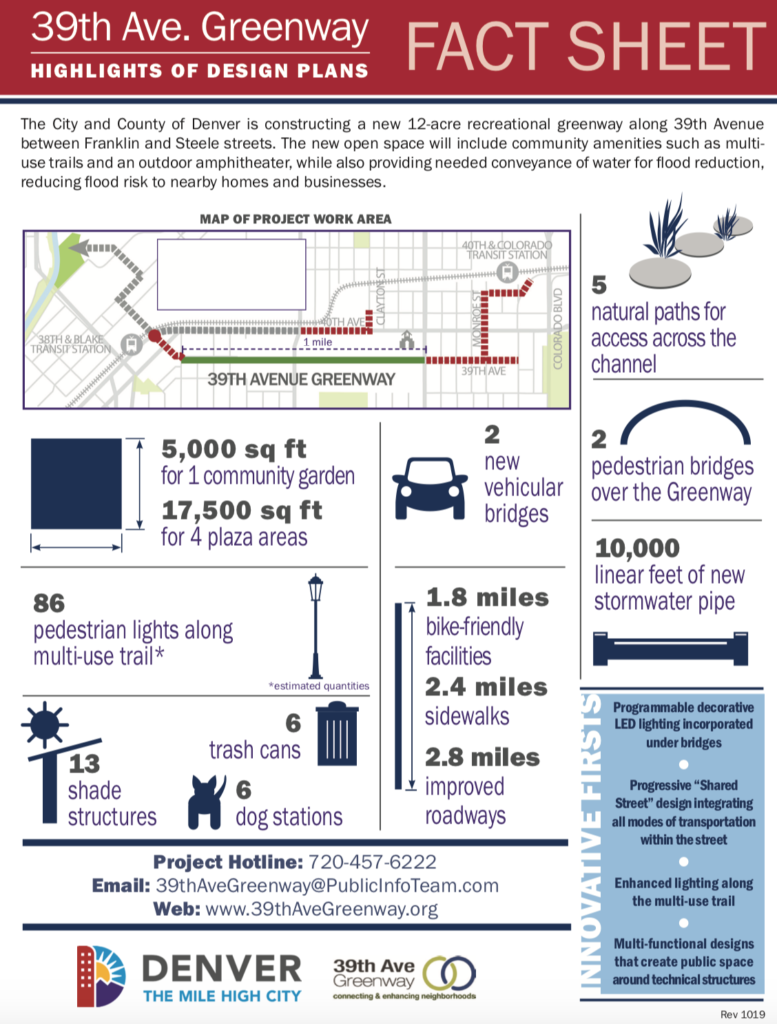

We are excited to highlight this project that has been in the works for years. Denver’s newest greenway will be operational in 2020. The 39th Avenue Greenway is a magnificent 12 acres greenway that will start at Franklin & 39th Ave in the Cole neighborhood near the new 38th & Blake train station. The beautiful trail will run east all the way to Steele street with 4 plazas, 86 lights, 2 new pedestrian bridges, 1.8 miles of bike trail, 2.4 miles of new sidewalks, and 13 shade structures. It will connect to the 40th and Colorado train station and almost reach Colorado Blvd.

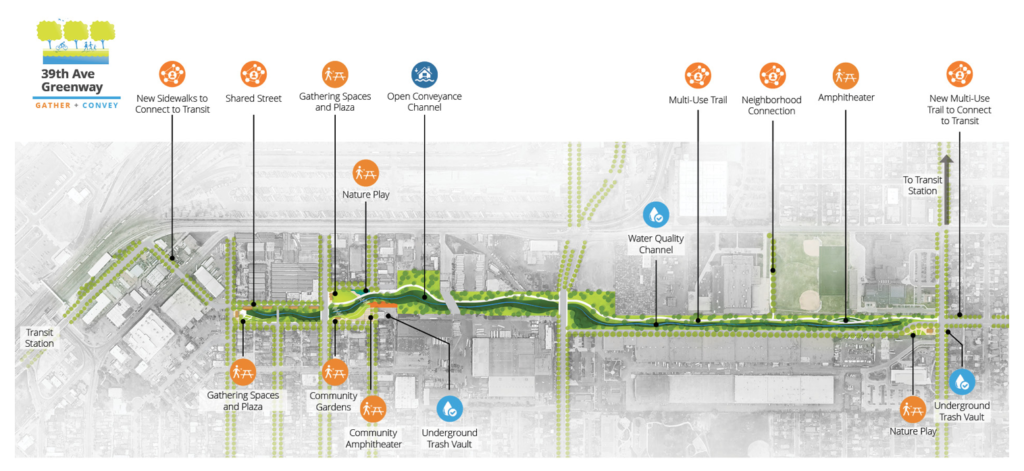

39th Avenue Greenway Draft Design Concept

The 39th Avenue Greenway and Open Channel will effectively and safely convey floodwater to the outfall at Globeville Landing Park. Outside of storm events, the area will remain mostly dry.This channel is an integral part of Platte to Park Hill: Stormwater Systems. It will be designed using a community-focused approach to provide the following benefits in addition to flood protection:

- Add 12 acres of new recreational open space in the Cole neighborhood

- Enhance community connectivity, including a biking/walking trail between Franklin and Steele streets

- Improve the quality of stormwater entering the South Platte River

More information about the project can be found here.

Here are some photos of the project in progress.

Do you have home equity?

Disclaimer: We are not lenders, we are not financial advisors, we are not accountants, we are not attorneys.

Do you have home equity? Wondering how you can use it to your advantage?

So you bought a home a few years ago and have EQUITY! The value has gone up, but how can you use the gain in value to your advantage? Home value is not a liquid asset, but with a tool called a Home Equity Line of Credit (HELOC) you can utilize your equity on your primary residence without selling your home. There are several institutions that offer this type of credit and we’ve done some shopping around for you to help you pick the best program.

We called the top five banks that were recommended for their HELOC programs. We gave all of them the same scenario. The given scenario was: The homeowner’s agent said their house is worth $500K. The owner purchased the home for $400K two years ago and currently has a loan on the property for $380K. Their credit score is 750, income is $60K, debt = $2000/m for mortgage, $250/m car payment, $3000 in credit card debt.

Disclaimer: Rate fluctuate everyday and are based on your personal scenario, the rates below are just estimate for demonstration. Rates were as of July 2019.

The amount of money you can borrow for a HELOC will be calculated by multiplying the current home value by the percentage (typically 80-90%) and subtracting the current loan on the property. EX: $500K (current home value) x .89 (loan to value) = $445K – $380K (loan on home) = $65,000

Here is how we would rank the HELOC programs that we researched.

1. Bellco – 80% at a fixed 3.99%, 80-90% at a fixed 4.49%

2. Red Rocks – 89% at a 5.5% adjustable rate

3. Vectra – 85% at 5.35% to 5% adjustable

4. US Bank – 85% at 6.3%

5. Chase – 80% at 9.38%

Here are some assumptions you can make about most HELOCs…

1. Will have an adjustable rate and will fluctuate with the market rate during the term of the loan. BELLCO is running a special right now on a FIXED RATE HELOC

2. Can only be taken out a your primary residence

3. Payments are typically interest only

4. You will have to pay for an appraisal, closing cost, and it will usually benefit you to open an account at the institution

5. Unlike a second mortgage, a HELOC gives you access the the equity but you don’t have to pull out a lump sum

So now that you know what some local banks are offering, let’s think through a few scenarios on how you could utilize a HELOC. We must mention, HELOCs are NOT bottomless piggy banks to fund affluent lifestyles that you really can’t afford. The frivolous use of HELOCs in part lead to the Great Recession in 2008.

1. Moving Up – Many homeowners utilize the equity they have in their first home to purchase a second home. In Denver’s competitive housing market it can be extremely difficult to purchase a new home with a contingency to sell your current home. Also, many families don’t want to sell their current home without having a replacement home under contract. HELOCs are a solution many buyers are utilizing to avoid this dilemma. You can make an non-contingent offer, use funds from a HELOC as the down payment on your replacement property, and close on your new home THEN list your first home. With the proceeds from the closing of your first home you will have to pay off the first mortgage and HELOC in full. All the banks we spoke with confirmed that a HELOC can be used for anything… including the purchase of another home, but MAKE SURE TO CHECK WITH YOUR LENDER!

2. Home Improvement – Are there aspects of your home that you would like to improve? If so, a HELOC might be a great option for you. A HELOC allows you to borrow against the equity you already have in your home. Allowing you to finance these larger purchases over time instead of in one lump sum. Keep in mind that many of these rates are typically not fixed and payment are interest only, so having an established payment plan that includes a strategy to pay down the principle will be in your best interest. When considering home improvements, be sure to be mindful and discuss your improvement plans with your trusted real estate agent. Your agent can help you navigate what improvements are going to bring the most value back into the home when you sell. Take it from us, there is nothing more discouraging than putting a lot of money into a home that does not increase the value.

3. Consolidating other higher interest loans – Have you evaluated the interest rate on your student loan and credit cards? It can be extremely difficult to pay off high interest loan debt if you interest rate is 19.24% (average credit card interest rate). It might benefit you to use a HELOC to pay off debt with a higher interest rate.

We can help you with any real estate questions including: How much is my house worth? What is the best strategy to buy a second home? What renovation projects give the best return on investment. Call us: 303-720-8491

The Real Cost of a HOA

|

|

Condo: $520K with HOA $502/M = Mortgage Payment w/ 20% down = $3151

Parking: 1 reserve spot

Outdoor space: Private deck and shared rooftop deck

HOA covers: Common Area Grounds Maintenance, Covered Parking, Exterior Maintenance w/ Roof, Insurance, Sewer, Snow Removal, Trash Removal, Water

Townhouse: $619K with NO HOA = Mortgage Payment w/ 20% down = $3266

Townhouse: $619K with NO HOA = Mortgage Payment w/ 20% down = $3266

Parking: 2 car detached garage

Outdoors space: Front porch, two decks, small fenced backyard

Party wall agreement with neighboring unit, insurance will be a little more expensive, and you will be responsible for mowing and shoveling snow.

Is wholesaling wise or wack?

The real estate industry is very complex and there are many ways to buy a house. Recently I have been doing research on “wholesaling”. Wholesaling is a term used in the real estate industry to describe the process of finding great real estate deals and getting paid to bring them to real estate investors.

In the Denver market, wholesalers have large teams working to try to find off market deals through their networks, mailings, etc. They also use the MLS, where they buy about 50% of their inventory. When they find a deal with a little bit of margin they quickly see the house, write an offer and get the property under contract. Once the property is under contract they immediately open it up to a pool of investors, acting as a middle man. They benefit by taking the 2.8% commission offered on the MLS and usually increase the list price $3,000 to $10,000. Within a few hours or days they have found an investor who will pay cash and do a double escrow closing the same day they are scheduled to close with the original seller.

Real life example:

Property near DU went on the MLS at 9am. By 9:15 wholesale team has a showing and has spoken with the seller. They submit a full price, $384,050 cash as soon as they finish the showing by 10am. They agree to buy the property “as is” and their only contingency is Title with a two week closing. They give the seller one hour to accept. They also sweeten the terms by paying for title and use a company that allows double escrow closings (most title companies do not allow this). The listing agent is representing her family in the sale of her late mother’s home and has no idea that the buyer is really a middle man who is actually just reselling the property to a higher bidder. That evening, a large wholesale team has put together a packet which includes comps, update costs, and an After Repair Value (ARV) estimates which they conclude is $530K by converting the attached one car into a master suite and updating the kitchen and bathroom. Each wholesale team member emails the packet to his/her database of investors. The next day they parade investors through the home (without permission from the seller) until they find an investor to purchase it for $389,500. They will make $5,500 above the asking price they paid and take the commission of $10,752 equalling a profit of $16,252. The deal closes in two weeks and usually the buyer uses Hard Money to finance the purchase which is also available through the wholesale company. In this particular example, the cost of the hard money is 2.5% upfront ($11K) and 12% per month ($5K). If the rehab takes 6 months, the loan will cost the investor $41K. The wholesale company estimates the cost of the rehab is $55K. This property will be back on the market in a few months and probably sell for around $530K to a home buyer.

Conclusion

Investors prefer to focus on the construction projects and wholesale companies provide a benefit by identifying these properties, getting them under contract, doing the research on comps and ARV, and providing hard money. For a regular homebuyer and real estate agent, it is very difficult to compete against wholesale companies for the same properties. Luckily, they are usually buying the type of properties most buyers would not consider purchasing as a primary residence.

In the Denver market, buyers are faced with three major challenges: 1) the market moves very quickly, 2) they end up competing against multiple offers, and 3) buyers face off against cash offers. After gaining understanding about how this process works, it is difficult not to point the finger at these wholesale companies and blame them for the escalating prices and difficult conditions buyers face. Wholesalers have figured out the game and homeowners with the right agent and knowledge can benefit from understanding their techniques. When you purchase a home that has been flipped, you are potentially taking on the cost of the wholesaler and investor, they are passed onto you and easier to stomach when you have access to a 30 year loan.

I’ve got an idea!

Let’s play out a different scenario. A homeowner sees the same house on the MLS. They can’t get there immediately, and end up competing against multiple offers and it gets bid up to $400,000. They hire a contractor and pick the exact finishes they like for the home and invest $55K into the property. Rehab loans are a good option for this type of project. After a six month project, they end up with a home they love for $455,000 and have almost $100K in equity.

Disclosure: Managing a large project like this is risky and very time consuming. It’s not a good fit for everyone. Investors have years of knowledge, lots of capital, and strong relationships that make these project less expensive and easier. Now you know! Please let me know if you have any additional questions.